In an era of fragmented attention, finding opportunities to meaningfully engage with consumers and drive impactful outcomes is more important than ever. With European businesses anticipating flat or slightly increased marketing investments over the coming 12 months, marketers face tough decisions on how they strategically allocate their resources. Heading into 2026, they must plot a course through the dynamic digital landscape to reach their business goals.

Comcast Advertising partnered with independent research firm Longterm Colab for the sixth year running to survey marketers – agencies and advertisers – across five European countries to see how they are allocating budgets, adjusting spending priorities, and preparing for 2026.

Between July and August 2025, Longterm CoLab surveyed 500 marketing decision-makers and influencers in the UK, France, Germany, Italy, and Spain*. Respondents were evenly split between advertisers and agencies.

Key findings:

- Optimism among European marketers is subdued, with most expecting overall budgets to remain flat. French (43%) and UK (39%) marketers are the most optimistic that their budgets will increase

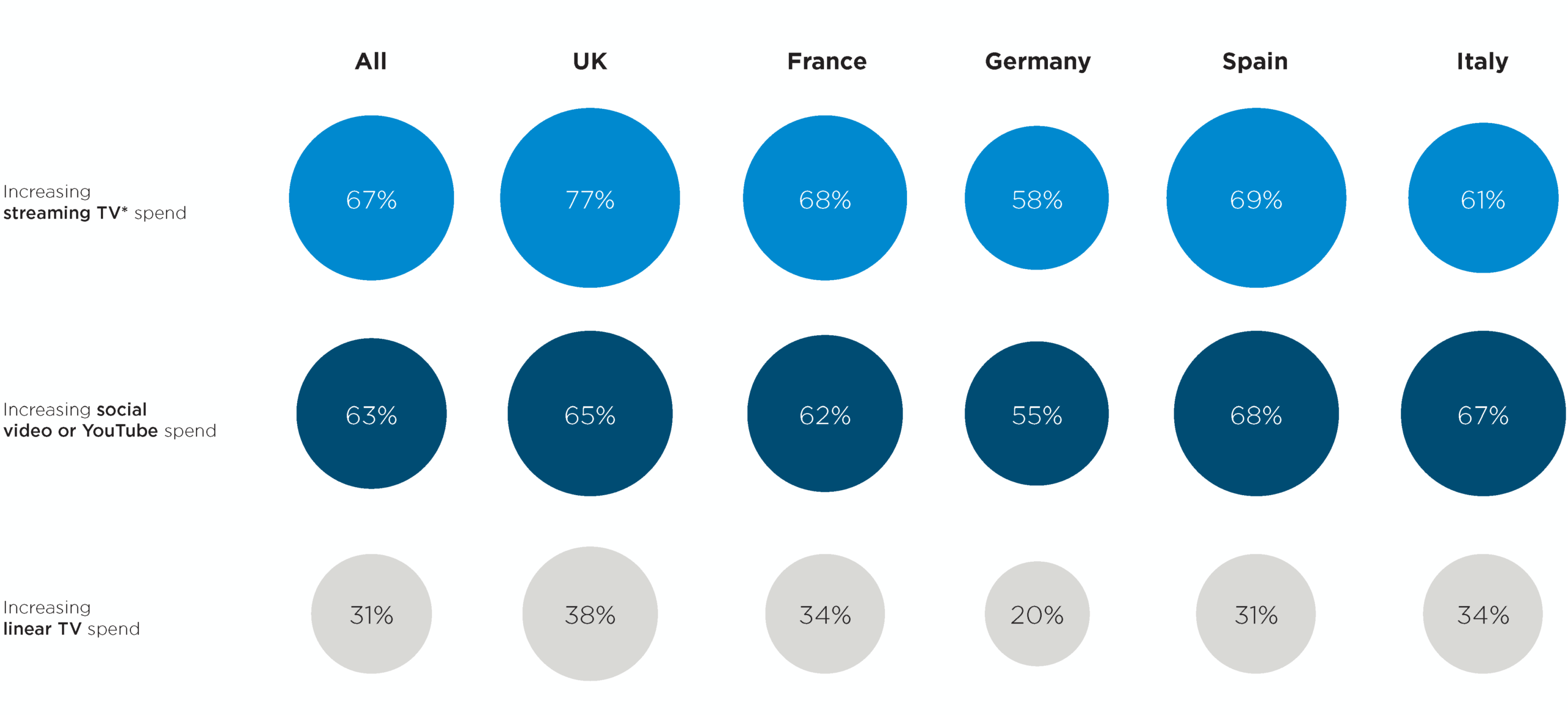

- Most regional marketers (67%) plan to increase streaming TV investment next year, with the UK showing the highest expectation in Europe (77%)

- The key driver of streaming investment is the quality of the ad experience, cited by 41% of respondents, while platform proliferation remains the chief blocker to further investment

- Building loyalty, growing revenues and brand building are key marketing priorities for European brands over the next 12 months

- Getting to grips with generative AI is the top strategic priority for 34% of European marketers, while environmentally sustainable advertising practices are becoming increasingly important – especially in France and Italy

Optimism over marketing budgets is subdued

Amidst global geopolitical tensions and slow economic growth, optimism among European marketers is cautious. Most expect their overall budgets to remain flat, with a -4% budget growth expectation across the region. However, French (43%) and UK (39%) marketers see higher levels of optimism that marketing budgets will increase in the next 12 months.

Question: How do you expect your overall marketing budgets to change over the next 12 months?

Marketers plan to increase streaming TV budgets

The study reveals that streaming TV and CTV are a standout priority for European marketers as they seek to connect with audiences increasingly turning to on-demand and ad-supported streaming platforms.

Across all respondents, more than two-thirds (67%) anticipate increasing their streaming TV spend in the next 12 months. This trend is most prominent among UK marketers, with 77% planning to up their budget, closely followed by Spanish (69%) and French (68%) respondents, both exceeding the overall European average.

Investments in streaming TV are on the rise across various sectors, with the medical (82%), FMCG (79%), and consumer electronics (78%) industries showing the greatest interest.

Overall, marketers are increasingly prioritising streaming budgets over social video and YouTube (67% vs 63%), signalling a broader industry recognition: in an era of fragmented attention, the ability to engage viewers in high-impact, uncluttered, brand-safe environments is more valuable than ever.

Question: Do you intend to increase or decrease how much of your marketing budget is spent with the following TV and video platforms in the next 12 months?

Growth drivers: Ad experience, reach, analytics

The top three drivers of investment in streaming TV and CTV remain unchanged from the previous year: the quality of the ad experience (41%), reach (38%), and real-time analytics (36%) all remain stable at the top of the list. This shows that the capabilities of streaming TV are cementing their place in the minds of marketers as the medium matures.

When comparing advertisers to agencies, the former were more likely to cite interactive ad formats and advanced targeting options as key drivers for further investment as they seek to continue innovating and enhancing the ad experience for viewers. Agencies, however, have a bigger focus on analytics and KPI-driven optimisation tools as they seek to prove ROI.

Growth inhibitor: Platform proliferation

The streaming TV market is highly fragmented and this complexity continues to be a major inhibitor to growth. More than four in ten (41%) marketers said there are too many platforms and associated buying tools, with French advertisers in particular (62%) seeing this as a hurdle to investment. With considerable marketer time and effort required to plan and trade across different platforms, this is a key issue that must be overcome to drive growth in the sector.

European marketers are increasingly confident in embracing CTV and streaming channels, as concerns about their effectiveness have significantly diminished, dropping from the second biggest investment blocker in 2024 to bottom of the table in 2025.

Priorities for 2026 centre around loyalty, growing revenue and brand building

Once again, marketers are prioritising customer retention and building loyalty (56%), consistent with the findings from the previous three surveys, as persistent challenging economic conditions continue to impact consumer confidence. While respondents in France (60%), Germany (58%) and Spain (57%) agreed on this top priority, marketers in the UK were more likely to focus on growing revenue and building market share 62%).

Overall, growing revenue was cited as the second most important (55%) marketing priority among European marketers. While this could be interpreted as being an indicator of a short-term strategy, brand building has seen a notable increase in importance this year, ascending to the third position (49%) on the priority list.

Harnessing generative AI becomes a strategic priority

The survey also uncovers the key strategic priorities for marketers for the year ahead, with harnessing the benefits of generative AI – such as scaling up content creation and personalisation efforts – considered to be the most important by 34%, up from third place in last year’s report. With AI being widely used across marketing departments to boost efficiency, marketers need to strategically consider how to leverage it for more impactful campaigns if they want to maintain and grow their budgets.

That’s why it’s encouraging to see investment in campaign effectiveness measurement in third place (29%) on the strategic priorities list this year, just behind using automated ad tech (31%), as this will help marketers quantify real outcomes. Environmentally sustainable advertising was the fourth-ranked strategic priority for European marketers overall (28%), showing that marketers are keen to respond to consumer demand for more eco-conscious products and services. This is especially true in France (38%) and Italy (33%).

Premium video remains a cornerstone of modern marketing, effectively addressing European marketers' unique market needs and supporting their key marketing goals, from increasing loyalty to building market share and long-term brand health. When marketers pair high-quality content with technical advancement, such as programmatic and AI, they can turn complexity into opportunities. Although thoughtful adoption of AI is essential, the true value of these tools lies in achieving a balance of efficiency and effectiveness, not just streamlining decision-making, which is key to ensuring brands remain relevant in the constantly evolving digital landscape.

Emmanuel Josserand, Senior Director, Brand, Agency and Industry Relations, Comcast Advertising

* For the purposes of this article, the UK, France, Germany, Italy, and Spain will collectively be referred to as “European marketers”.